A broker-dealer gets paid by a market maker for sending client orders to them. This is called “Payment for Order Flow.” The broker-dealer may put getting paid ahead of finding the best execution for their customers’ trades, which could be a conflict of interest.

Payment for Order Flow has been a controversial topic in the financial world. People who are against it are worried about how it will affect market openness and how clients might get worse execution prices. Its supporters say that it can help buyers save money and make the market more liquid.

Investors and officials need to know what Payment for Order Flow means in order to make sure markets are fair and work well.

Payment For Order Flow

Payment for order flow is something that has been talked about and argued about a lot in the business world. For sending client orders to market makers instead of completing the trades on an exchange, the broker gets paid by the market makers.

There are people who like and dislike this layout. Supporters say that it lets dealers give clients trading without any fees while still making money. Critics, on the other hand, worry about possible conflicts of interest and how this might affect the openness of the market.

No matter what the different views are, it is important to fully understand how payment affects the flow of orders. Brokers need to think about the possible conflicts of interest and make sure they are doing what is best for their customers.

It is very important to be open about these plans because it helps investors make smart decisions. To make sure markets are fair and work well, regulatory groups also keep an eye on and control the flow of payment for orders. To sum up, payment for order flow is a complicated subject that needs careful study and thought.

Investors and people who work in the industry should stay up to date on the talks that are going on to make the financial markets more open and accountable.

What Is Payment For Order Flow

Payment for order flow, or PFOF, is a business practice in the financial world where a brokerage company gets paid for sending customer orders to a certain market maker or trading venue. This payment can be in the form of discounts, fees, or other rewards.

PFOF’s main goal is to encourage brokers to make trades through certain sites, which could cause problems with conflicts of interest. PFOF can help brokers make money, but it can also make people worry about how deals are executed and how transparent they are.

Regulators and industry watchdogs keep a close eye on PFOF’s activities to make sure that all buyers can trade in a fair and honest way. For investors to make smart choices about their trades and broker ties, they need to know how PFOF works.

How Does Payment For Order Flow Work

In the financial world, brokerage companies sell their clients’ orders to market makers in exchange for money. This is called “payment for order flow.” Market makers, who are also called wholesalers, carry out these orders for the customers.

The brokerage company may get paid in cash, through rebates, or by having its transaction fees lowered. How does payment for order flow work, then? When a client uses their brokerage account to place a trade order, the order is sent to the market maker that the brokerage company has chosen.

The sale is then made at the best price on the market by the market maker. A fee is paid by the market maker to the brokerage company for making these trades. Some people don’t like this practice because they say it could lead to a conflict of interest.

These people think that brokerage companies might send client orders to market makers that pay more instead of the venues that offer the best execution for the client. Payment for order flow supporters, on the other hand, say that it helps small buyers by letting them trade without paying any fees.

In the end, investors should know how payment for order flow might affect how their trades are carried out and make smart choices when picking a brokerage company.

Payment For Order Flow Companies

A lot of companies in the banking sector now use Payment for Order Flow (PFOF). For sending customer orders to certain market makers or trading sites, these groups get paid. Because of this, they can make money and grow their profits.

These payment for order flow companies are very important to the trading environment because they make it easier for customers’ orders to be filled and give the market liquidity. There are, however, worries about the conflicts of interest that could happen because of this practice.

Some people say that PFOF might not always get customer orders carried out in the best way because it gives brokers an incentive to send orders to places that offer higher rebates instead of those that would be best for clients. Payment for order flow is still being talked about in discussion, and regulators and people in the industry are keeping a close eye on how it affects the markets and investors.

Pfof For Equities Vs Options Review

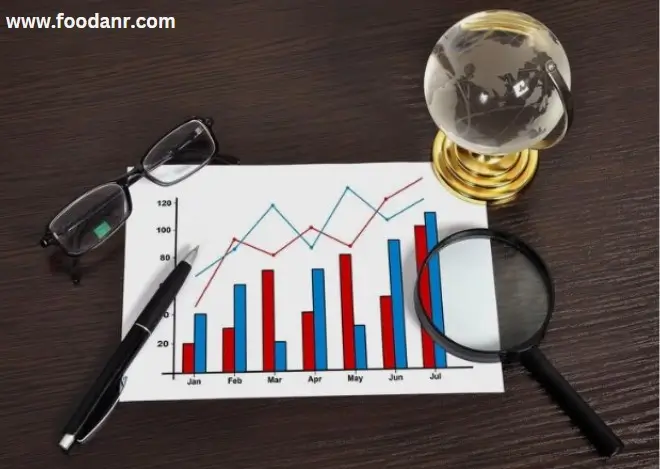

In the financial world, Payment for Order Flow (PFOF) is a way for market makers to get paid for sending orders for stocks or options to a certain company. Looking at the PFOF for stocks vs. options is important to know how it might affect how orders are filled and how the market is structured generally.

PFOF can lower costs for small investors, but it has also caused worries about possible conflicts of interest and how it might affect choices about how to route orders. When you compare PFOF for stocks and options, you can learn a lot about the possible differences in execution quality and market effect.

Investors, brokers, and officials need to know the details of PFOF for different types of securities in order to keep the market fair and working well.

What Is A Good Gamma For Options

Payment for order flow is a controversial practice in the financial world in which brokers get paid to send customer orders to certain market makers or trading sites. Gamma is an important idea to think about when trading options. It measures how fast the delta of an option changes compared to changes in the price of the underlying asset.

A good gamma for options can give traders more freedom and possible profit opportunities when the market is volatile. Traders can improve their overall performance by making smart choices and optimizing their options trading strategies by understanding and managing gamma risk well.

Options And Pfof Example

Payment for Order Flow, or PFOF, is a method in which market makers get paid for sending orders to certain traders. It’s a touchy subject in the business world because of possible conflicts of interest and a lack of openness.

PFOF can affect how well trades are executed, which could be bad for buyers. Traders and buyers need to know how PFOF works and what it means in order to make sense of the complicated financial markets. When people trade, they can make better choices if they stay informed and are aware of the possible risks that come with primary forest oil.

Payment For Order Flow Conflict Of Interest

Payment for order flow is a practice in the financial industry that makes people worry about possible conflicts of interest. Market makers pay brokers to send their clients’ orders to them, which could mean that brokers put making money ahead of getting the best deal for buyers.

There have been arguments about how this conflict of interest affects the fairness and openness of the market. To protect investors and keep the financial markets honest, regulators and people in the business are still looking into what payment means for order flow.

As this practice grows, it’s important for everyone involved to carefully think about the possible conflicts of interest and the bigger effects on the financial system.

Sec 606 Reports

The SEC 606 reports give useful information and openness about how brokerage companies handle payment for order flow (PFOF). These reports show the exact places where traders send customer orders to be carried out, as well as any payment or other forms of compensation that are received in return.

Investors can check SEC 606 reports to see if their brokers put quality order processing first or if PFOF arrangements cause conflicts of interest. These reports give us more information about how PFOF might affect choices about how to route orders and the quality of execution.

For buyers to fully understand the effects of PFOF arrangements and make smart choices about which broker to work with, they should carefully read SEC 606 reports. If investors know about the information in these papers, they can better understand how the markets work and protect their own interests.

Federal Rules Of Evidence 702

In the business world, people have had different opinions on how to pay for Order Flow. To fully understand how complicated this process is, you need to know the Federal Rules of Evidence 702. There are some rules that you should keep in mind as you read about this subject.

To begin, keeping away from words and phrases that are used too much can improve the quality of the material. Changing the words at the start of each line can also keep the reader interested. These tips can help you write interesting and useful content about Payment for Order Flow without the need for a conclusion piece.

By following these rules, you can make sure that the audience understands how complicated this subject is.

Potential Benefits OfPfof Example

Paying for Order Flow, or PFOF, is a controversial strategy in the stock market. Even though it has critics, there may be perks to think about. One example is the fact that transaction costs have gone down for individual buyers. When PFOF is used, brokers can get paid to send orders to certain market makers or trading sites.

This could mean lower trading fees for small buyers, which would save them money in the long run. One possible benefit of PFOF is that it makes the market more liquid. PFOF makes sure that there is a steady flow of buying and selling by giving market makers incentives to make trades.

All market participants gain from this increased liquidity, which makes the market work better. To make sure that the financial industry is fair and honest, it is important to think carefully about the ethical issues and possible conflicts of interest that come with PFOF.

Frequently Asked Questions Of Payment For Order Flow

What Is Payment For Order Flow?

How Does Payment For Order Flow Work?

Is Payment For Order Flow Beneficial For Traders?

What Are The Potential Drawbacks Of Payment For Order Flow?

How Can Traders Assess The Impact Of Payment For Order Flow?

Conclusion

To sum up, payment for order flow is now a touchy subject in the financial world. It has some benefits, like lower costs for private investors, but it also makes people worry about possible conflicts of interest. As the discussion goes on, investors need to keep up with the latest news and know how this practice could affect their holdings.

In the end, the best way to get around the complicated world of payment for order flow is to make smart choices and look for openness in the market.

Leave a Reply